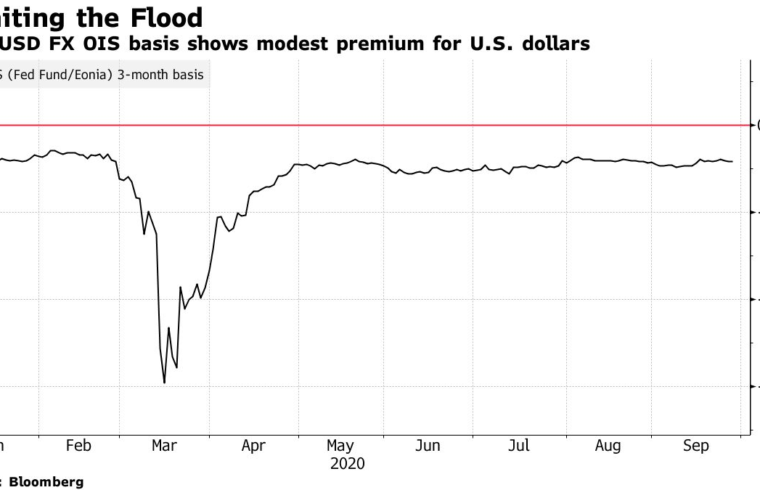

The Federal Reserve is about to decide whether to extend a ban on banks buying back their own stock. It may shape up to be pivotal for year-end funding risks.

If the Fed keeps its ban on buybacks in the decision due by end of September, banks will be stuck holding capital until next year and will “flood” the currency swap market with dollars to harvest year-end premiums, according to Credit Suisse Group AG.

The ban is likely to be extended — and as banks step into the funding markets, those year-end premiums can disappear, strategist Zoltan Pozsar wrote in a client note dated Sept. 27.

Until there is some certainty over buybacks, it’s likely that banks will keep reserves at the Fed and won’t lend them out in FX swap markets over year-end.

If stock buybacks are allowed in the fourth quarter, the systemically important U.S. banks — known as G-SIBs — would need to match any buybacks by reducing deposit rates, which would divert excess deposits to foreign banks, as they no longer have the capital to carry reserves added this year, according to Pozsar.