Photographer: Alex Kraus/Bloomberg

Photographer: Alex Kraus/Bloomberg

Dutch policy maker Klaas Knot defended his decision to go public with his dissent from the European Central Bank’s decision to restart bond-purchases after a contentious meeting that exposed a deep rift among its officials.

Speaking in an interview with Telegraaf newspaper published on Monday, Knot said the Governing Council knew of his plan to release a statement explaining his position. It came a day after the ECB decided on a new package of stimulus measures that also included a rate cut and easier terms of long-term loans for banks.

“There was wide consensus that it was better to be transparent about it than to let it develop into anonymous hearsay in the press,” Knot, who runs the Dutch central bank and sits on the 25-member Governing Council, told the newspaper. “Experience has taught us that such differences of opinion never stay behind closed doors.”

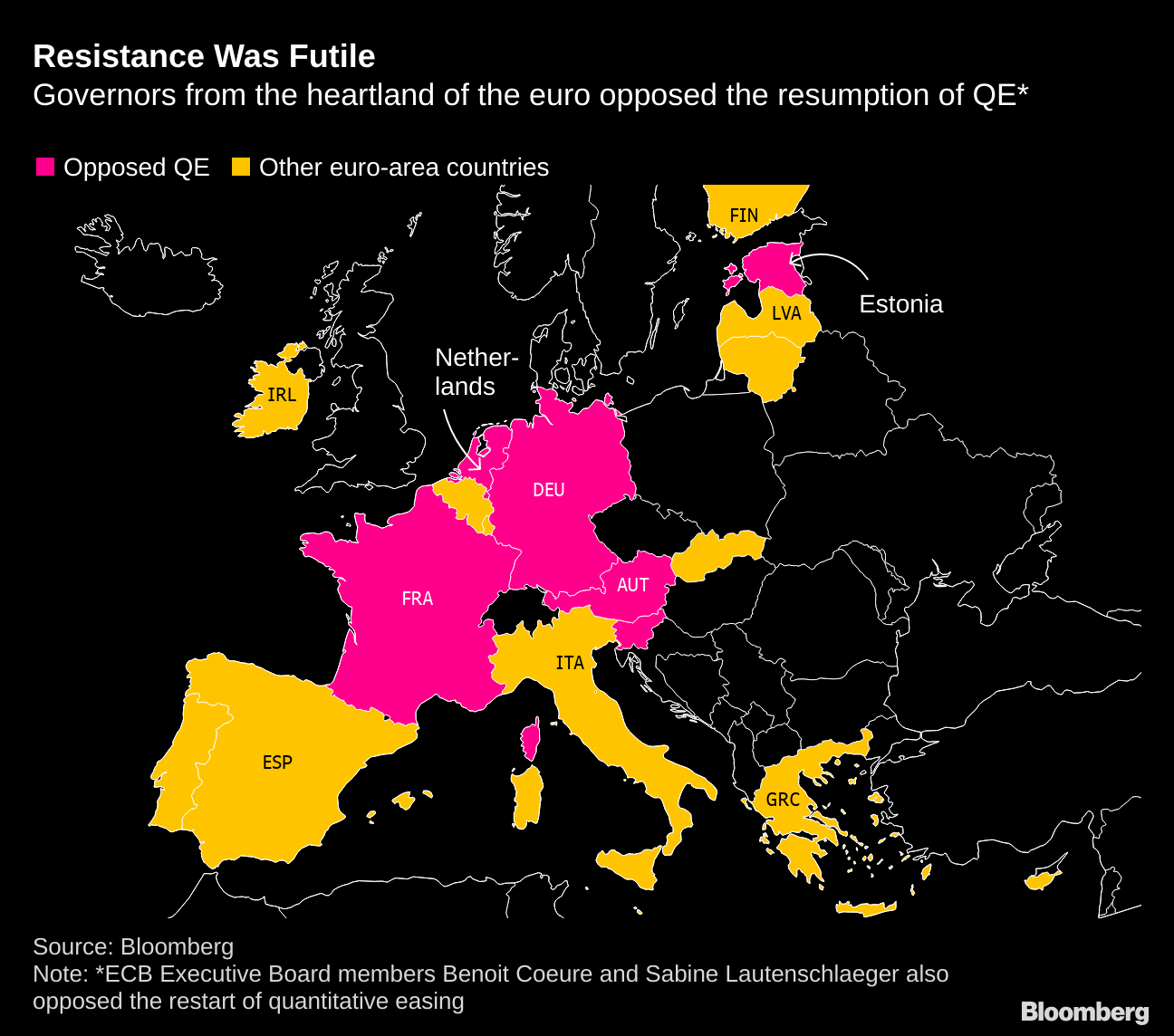

Resistance Was Futile

Governors from the heartland of the euro opposed the resumption of QE*

Source: Bloomberg

The ECB’s decision sparked an unprecedented airing of grievances among policy makers, with Austrian central bank Governor Robert Holzmann even suggesting the QE was a mistake and could be reversed. Presiding over his penultimate policy meeting as president, Mario Draghi pushed through a new round of bond-buying despite the opposition from around eight officials, central bank governors from France and Germany among.

Knot told Bloomberg in an interview before the meeting that he won’t support the QE, calling it disproportionate to economic situation. He reiterated his view in Telegraaf.

Knot is set to face Dutch lawmakers in The Hague later on Monday. Draghi will attend his valedictory hearing as president at the European Parliament in Brussels at 3 p.m. He is unlikely to escape questions about negative rates that have riled German public.

Knot, who will start speaking an hour earlier, could expect grilling about the impact of the ECB’s decisions on Dutch pension funds, a hot-button topic in the Netherlands. The governor told Telegraaf newspaper that the central bank, which is responsible for the 19-nation euro area, cannot adjust its policies to suit his country. But he acknowledged that some Dutch pensioners were getting a raw deal.

“If I were 67, I would also be annoyed,” Knot said. “But the Netherlands must set up the system in such a way that it can also deal with this low or even negative interest rate environment.”

The decisions that the ECB took after a “heated debate” earlier this month showed that low interest rates “aren’t exactly of a temporary nature, but rather becoming a quasi-permanent phenomenon,” he said.