A gas meter gauge stands at the oil and gas field processing and drilling site operated by Ukrnafta PJSC in Boryslav, Lviv region, Ukraine, on Thursday, July 4, 2019. Photographer: Vincent Mundy/Bloomberg

Photographer: Vincent Mundy/Bloomberg

Oil jumped in after-market trading following the Iranian Revolutionary Guard Corp seizing a British oil tanker and a Liberian-flagged ship in the Strait of Hormuz, raising stakes in the critical oil chokepoint.

Brent futures rose as much as 1.4% from its settlement, while WTI futures also edged higher after the seizure of the tankers. U.K. Foreign Secretary Jeremy Hunt said Friday that he is “extremely concerned by the seizure of two naval

vessels by Iranian authorities in the Strait of Hormuz.”

“With all the noise about potential negotiations with Iran, the reality is that geopolitical risk is enormously high in the heart of the oil producing gulf and key transport corridor,” said Joe McGonigle, an energy policy analyst for Hedgeye Risk Management and a former senior official at the U.S. Energy Department. “Iran’s only response to maximum pressure by the U.S. is maximum chaos in the region that tries to win concessions from the U.S. Iran’s seizure of the British tanker is just one example and we think the market should get prepared for more risk ahead.”

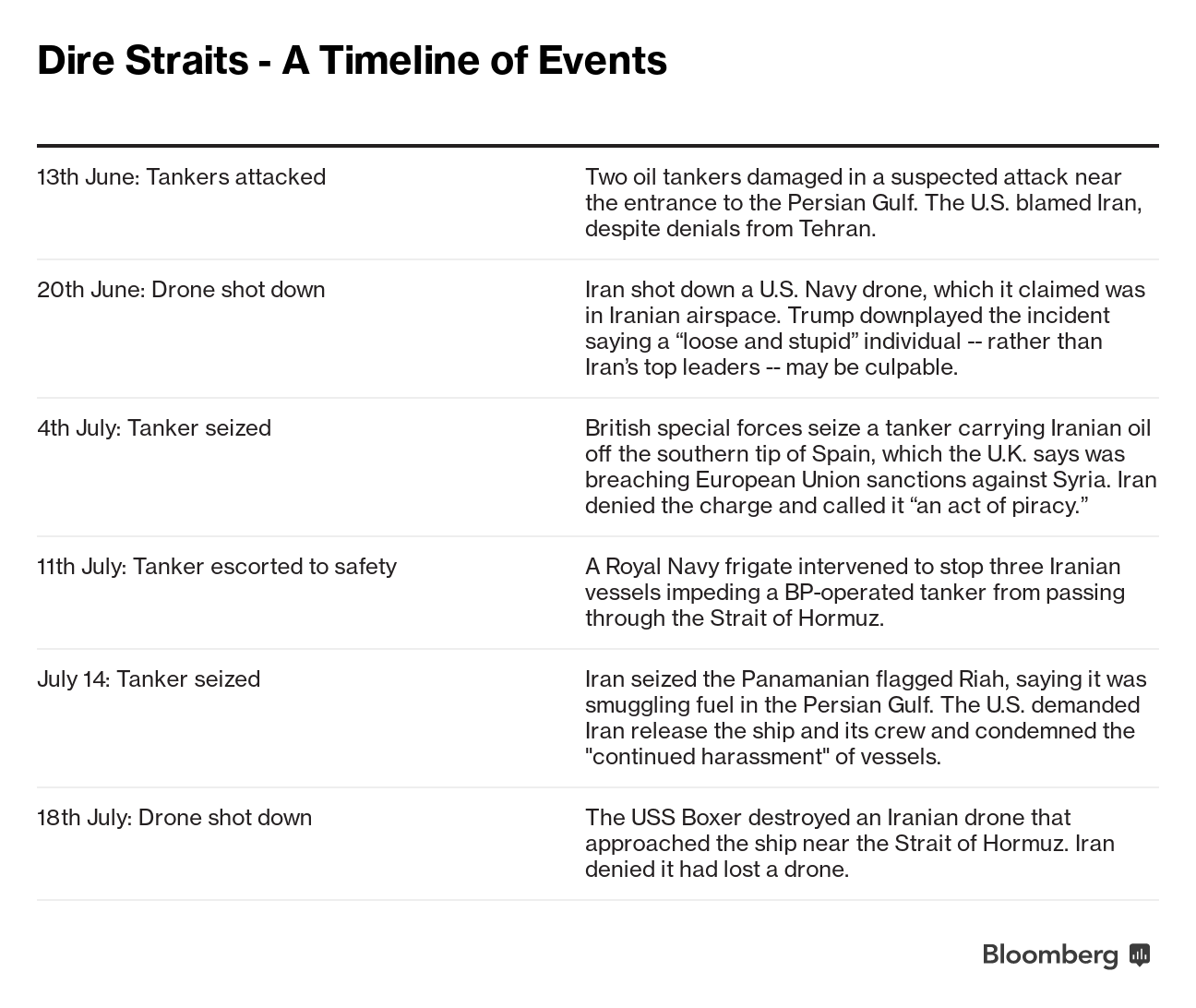

Dire Straits – A Timeline of Events

Despite the escalating conflict in the Middle East, New York futures ended the week 7.6% lower, the biggest weekly loss in nearly two months, amid fears about waning demand. The U.S.-China trade war and expanding American fuel stockpiles have also weighed on prices.

“The biggest factor driving oil prices today is the Iran-U.S. tension story,” said Phil Flynn, senior market analyst at Price Futures Group Inc. “The rallies appear to show the conflict in Strait of Hormuz might be more serious and that stakes are raised going into this weekend.”

West Texas Intermediate for August delivery traded at $55.76 a barrel at 4:46 p.m. after settling at $55.63 a barrel on the New York Mercantile Exchange.

Brent for September settlement traded as high as $63.37 a barrel before trading at $62.87 a barrel. The benchmark closed at $62.47 on the ICE Futures Europe Exchange.

See also: U.S. Demands Iran Release Foreign Ship, Crew Seized This Week

After the U.K. tanker Stena Impero was escorted into Iranian waters, a second vessel in the area, the Liberian-flagged Mesdar, appeared to turn toward the Iranian coast, according to ship-tracking data. The second tanker has left Iranian waters, according to Fars News.

In Washington, U.S. President Donald Trump said he will be “working with the U.K.” on the incident and suggested the latest developments justify his harsher approach toward Tehran. “This only goes to show what I’m saying about Iran: trouble, nothing but trouble.”

A spokesman for Iran’s Guardian Council suggested the move against at least one of the ships was in retaliation for the British seizure of a tanker carrying Iranian crude earlier this month.

“This is the second time in just over a week the U.K. has been the target of escalatory violence by the Iranian regime,”

Garrett Marquis, spokesman for National Security Council at the White House, said in an email. “The U.S. will continue to work with our allies and partners to defend our security and interests against Iran’s malign behavior.”

| Other oil-market news: |

|---|

|

— With assistance by Sharon Cho, Alex Longley, Kasia Klimasinska, Alex Nussbaum, and Stephen Cunningham