Planning a trip to the movies soon? Didn’t think so. Photographer: Anindito Mukherjee/Bloomberg

Photographer: Anindito Mukherjee/Bloomberg

As the Covid-19 pandemic wears on and drives permanent

changes to entertainment culture, Hollywood giants such as Walt Disney Co. and Comcast Corp.’s Universal Pictures appear to be

turning their backs somewhat on movie theaters. The largest among the cinema chains, AMC Entertainment Inc., is teetering on the brink of bankruptcy at the same time that it celebrates its 100th anniversary. Just a few short months ago, it seemed inconceivable that the business of filmmaking could carry on without the box office and surrender almost entirely to online streaming apps. But now it’s clear that Hollywood and audiences can get along without cinemas.

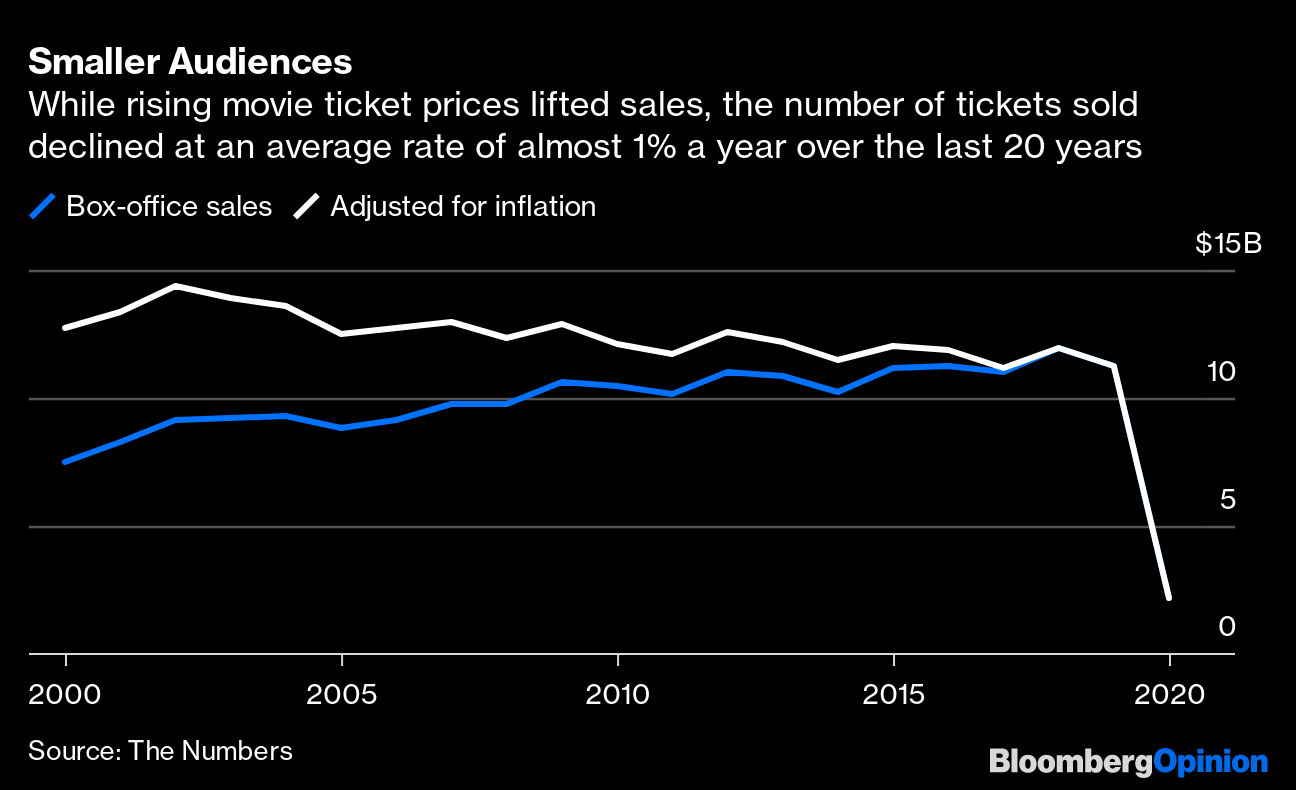

Smaller Audiences

While rising movie ticket prices lifted sales, the number of tickets sold declined at an average rate of almost 1% a year over the last 20 years

Source: The Numbers

hired advisers to help with its balance sheet, and AMC may run out of funds before the new year. “AMC’s cash burn could worsen beyond $115 million a month, while its cash reserves are only about $418 million,” Amine Bensaid, an analyst for Bloomberg Intelligence, wrote in a report last week. Leawood, Kansas-based AMC is controlled by Dalian Wanda Group Co. of China, where the industry is healthier; China, in fact, recently overtook North America as the world’s largest movie market. Netflix Inc.’s annual revenue also tops the U.S. box office and has for some time. The symbolism weighs heavy on U.S. cinephiles, and the reality of it has studios rethinking strategy.

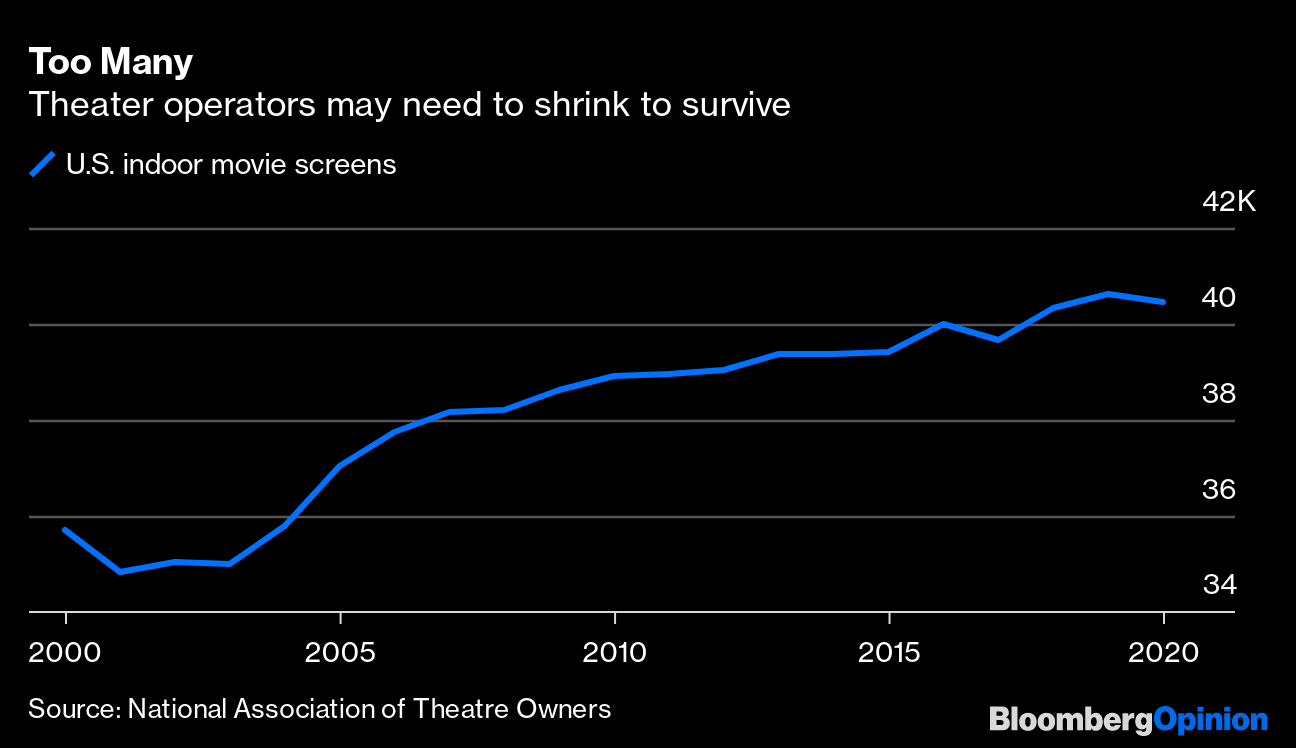

Too Many

Theater operators may need to shrink to survive

Source: National Association of Theatre Owners

news headlines mirroring those from March and April.

Disney has since pushed back a number of its upcoming releases, including delaying Marvel’s “Black Widow” to May 2021, a full year from when it was originally scheduled. The same goes for MGM’s “No Time to Die,” which is now set to arrive in April, although the studio reportedly held talks

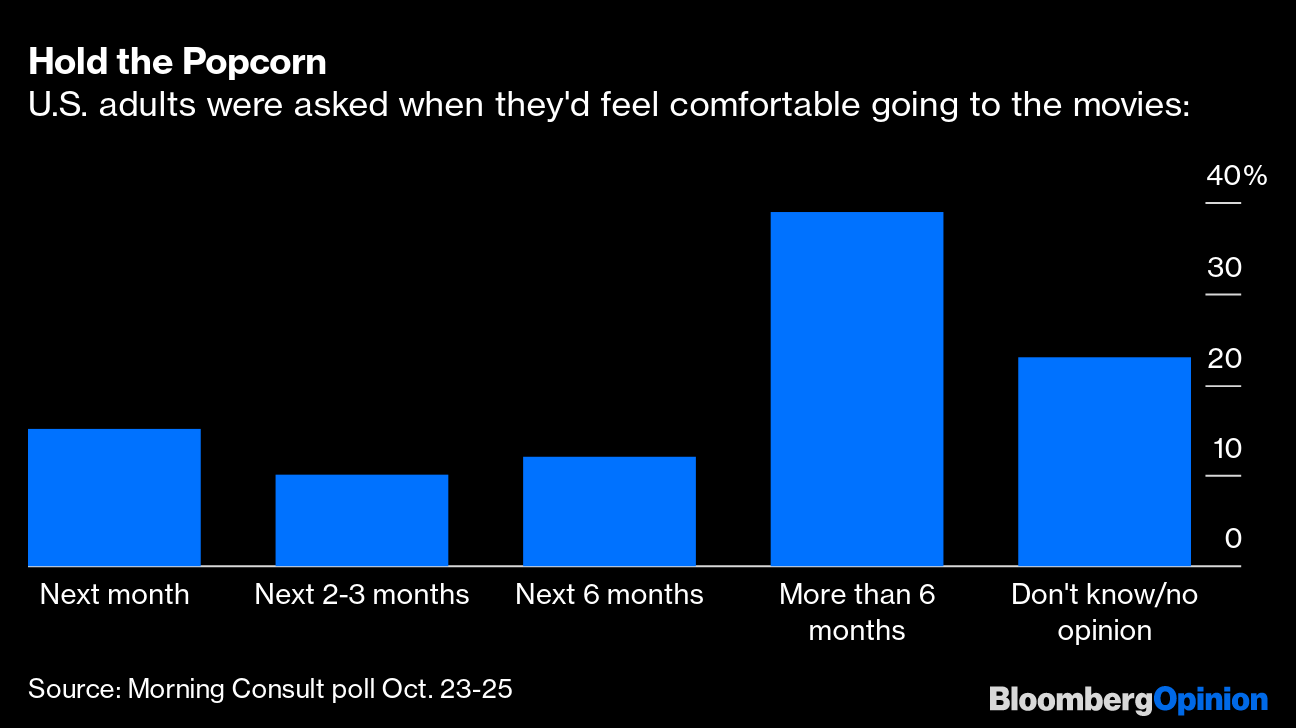

about selling the film to Apple Inc. or Netflix for their streaming services. Even as key New York and California theaters reopen, all signs point to weak demand until the U.S. gets a handle on the coronavirus. Only 26% of millennials — and far fewer baby boomers — say they’re comfortable returning to movie theaters right now, according to a weekly Morning Consult poll. Attitudes toward concerts, gyms, theme parks and overseas travel are much the same.

Hold the Popcorn

U.S. adults were asked when they’d feel comfortable going to the movies:

Source: Morning Consult poll Oct. 23-25

propped up the box office in recent years, and rising ticket prices helped mask traffic trends. Disney’s “Avengers: Endgame” grossed $2.8 billion in 2019, making it the biggest film of all time. Still, 162 million fewer tickets were sold in North America that year compared with 20 years ago, according to The Numbers, a box-office data provider. Theater owners responded by renovating auditoriums, improving snack options, installing reclining seats and — buying one another.

Between 2016 and 2017, AMC acquired its rural U.S. rival Carmike Cinemas, Odeon & UCI in London and Sweden’s Nordic Cinema Group for a total of $3 billion including debt. London-based Cineworld Group Plc bought America’s second-biggest chain, Regal, for $5.9 billion. The virus scuttled its plan to buy Canada’s Cineplex Inc.

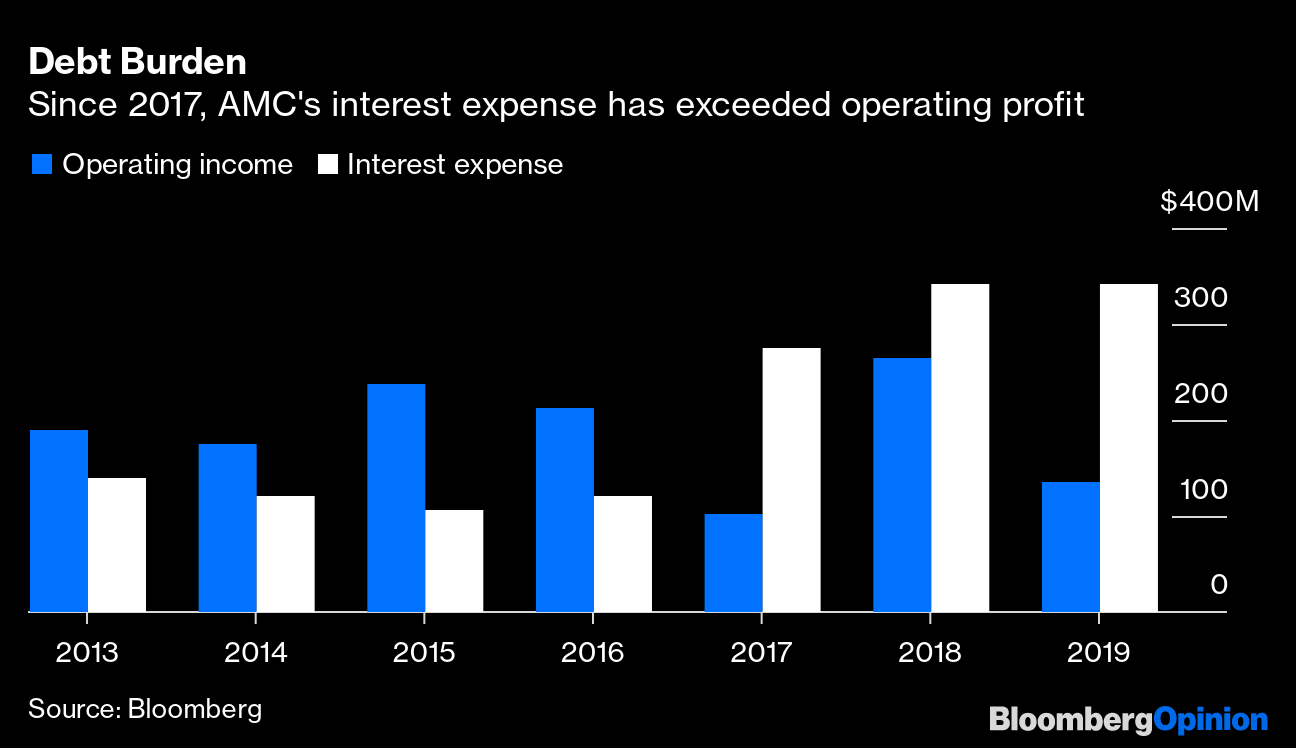

In a November 2018 earnings call, Adam Aron, the CEO of AMC, highlighted the company’s spending, pointing to its “robust dividend” and a $160 million special payout made to shareholders that year after it secured a large investment from a private equity firm. He also said that AMC repurchased some $500 million of stock, doubled its Dolby locations in the U.S. and was “renovating theaters like crazy in Europe.” Capital expenditures ballooned, and interest expense on AMC’s mounting debt began to eat up its operating profit — all before Covid entered the vernacular:

Debt Burden

Since 2017, AMC’s interest expense has exceeded operating profit

Source: Bloomberg

While the costly investments may have seemed wise at the time, they look much different through the lens of a Covid face shield. A strategy focused on fewer locations in the most profitable markets would have better prepared the industry for what’s to come in 2021: a massive downsizing.

AMC was among companies irked by the effects of a Financial Accounting Standards Board rule change last year that reclassified operating leases as debt, and its executives weren’t shy about saying so. The modification increased debt levels overnight and complicated the calculations of already squishy financial metrics used to compare businesses. After Covid shut AMC’s doors, though, the debt-like burden of those contractually obligated lease payments went from hypothetical to very real. In August, AMC said it reached agreements with landlords to “defer or abate rent” on about 75% of its 900 leases.

That was more than two months ago, and Covid-19 still hasn’t let up. It doesn’t look like a vaccine will fully thwart its spread in 2021 either. AMC and its rivals have no choice but to retreat from areas where the box office shows low odds of recuperating. Even then, how many theaters that remain can survive a streamer’s world?

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the editor responsible for this story:

Beth Williams at bewilliams@bloomberg.net