Repurchasing power isn’t all it’s cracked up to be. Photographer: SeongJoon Cho/Bloomberg

Photographer: SeongJoon Cho/Bloomberg

Last year’s disappointing market amid record stock repurchases should have taught investors and executives that corporate buybacks are not a panacea. But they appear to have missed the lesson.

Brian Reynolds, a strategist at Canaccord Genuity,

wrote in a report last week that the equity bull market will continue in large part because of “debt-fueled buybacks.” And at least some of those buybacks seem to be on their way. Fox Corp. and Charter Communications both did did bond deals, of $6.8 billion and $2 billion, respectively, and said the purpose was to raise cash for dividends and buybacks, though there is nothing forcing them use the proceeds that way.

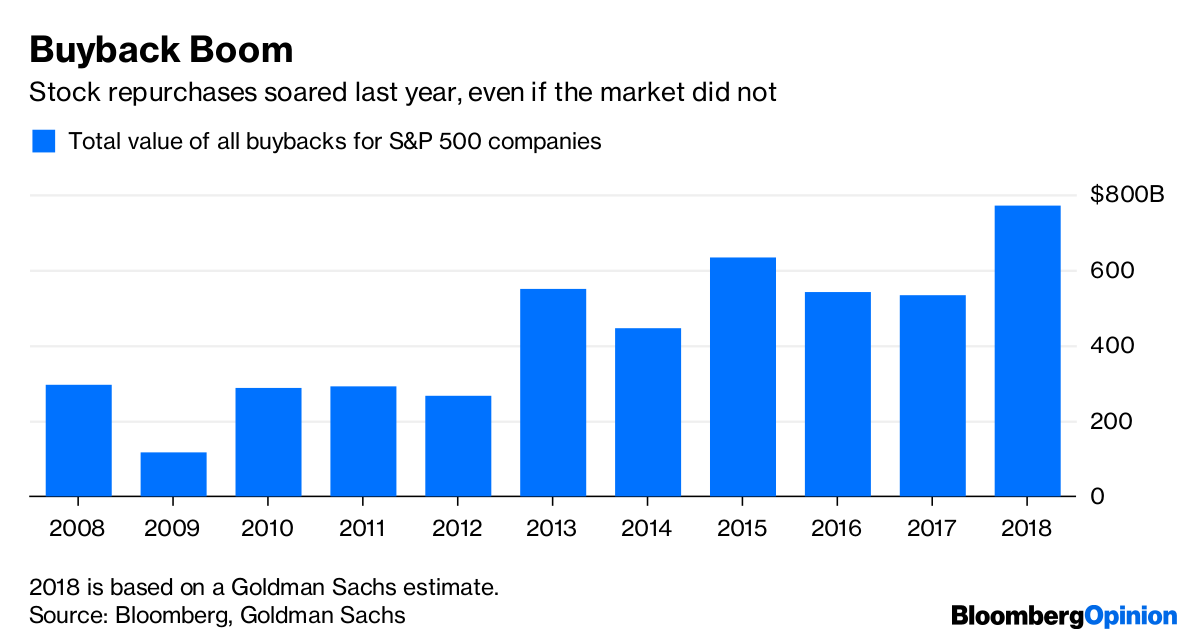

Buyback Boom

Stock repurchases soared last year, even if the market did not

Source: Bloomberg, Goldman Sachs

What’s more, corporate America has promised more in stock repurchases than it has completed, meaning the buyback train has already been loaded up with fuel. Last year, companies in the S&P 500 announced plans to buy back just more than $1.1 trillion worth of their own stock, according to Birinyi Associates. That was the first time that buyback pledges reached 13 figures. Yet according to Goldman Sachs, S&P 500 companies completed only $770 billion in buybacks, leaving $330 billion still to be done.

Even with the existing dry powder, if interest rates rise this year, as many still expect, it seems unlikely buyback activity will be able to match last year’s. If they drop, or stay low, as Canaccord Genuity’s Reynolds envisions in a Goldilocks buyback scenario, that will most likely be the result of a slowing economy, something that repurchases are unlikely to overcome. Moreover, buybacks appear to be making the market less stable, as

dips during share repurchase blackout periods have coincided with surges in volatility.

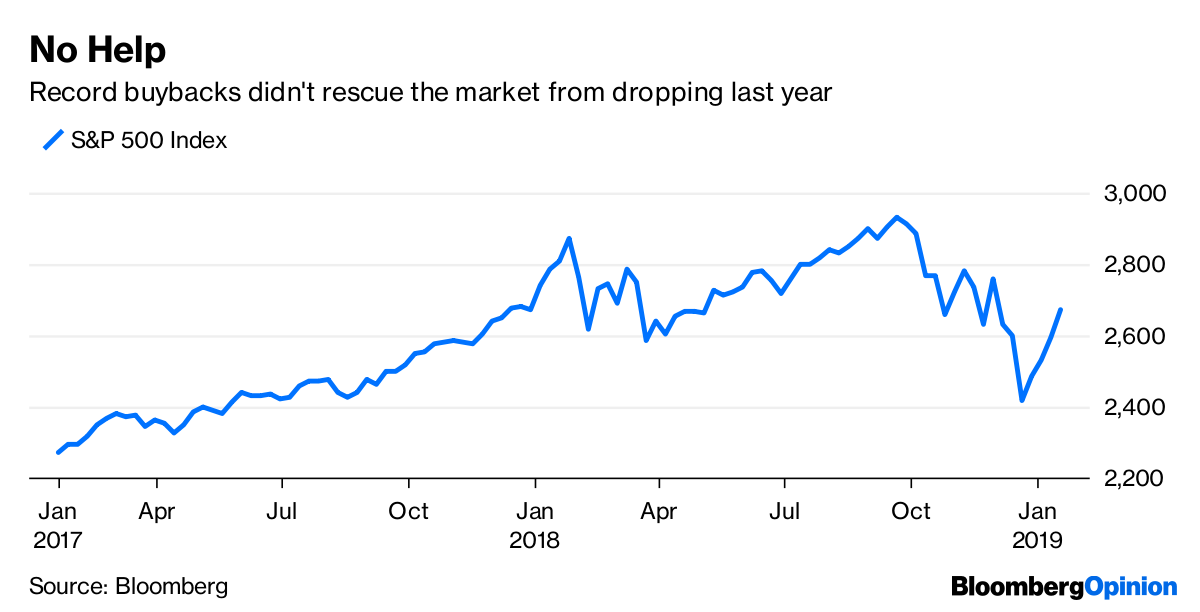

No Help

Record buybacks didn’t rescue the market from dropping last year

Source: Bloomberg

But the greater problem is that buybacks aren’t living up to their promise. They are supposed to boost the value of a company’s stock by lowering its shares outstanding and raising its earnings per share, which in theory should make its remaining shares worth more. Plus, as companies come into the market with cash, they can push up stock prices, like any other buyer. The investors they buy out, the theory goes, can then turn around and invest that money elsewhere, increasing the value of other stocks or making capital available for private companies. Somehow this virtuous cycle didn’t work out last year. Corporate stock repurchases should have boosted the value of the companies in the S&P 500 by 3 percent. Instead, their prices fell 6 percent. Yes, an argument could be made that stocks would have been down even more without buybacks, but the forces arrayed against them still exist, and if a record year for repurchases can’t deliver for investors, they shouldn’t count on buybacks to bail them out this year.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the editor responsible for this story:

Daniel Niemi at dniemi1@bloomberg.net