Want to receive this post in your inbox every day? Sign up for the Terms of Trade newsletter, and follow Bloomberg Economics on Twitter for more.

Sausages, ketchup and mustard, plastic plates — all essential ingredients for Americans tending to their grills this Labor Day weekend. Soon they’ll be 15% more expensive to import from China.

The picnic products are just a sampling of the more than 3,200 categories of Chinese goods targeted for the new tariff starting Sunday, barring a last-minute flinch by President Donald Trump. It’s the

next escalation of a trade war between Washington and Beijing that will add import taxes on about $112 billion in Chinese imports, including many consumer food items, household goods and apparel. It’ll also be a

good stress test of the strongest pillar of the U.S. economy at the moment: consumers.

In the days leading up to the next wave of U.S. levies, China is calling for calm and more talks. No details had emerged as of early Friday in Washington about a call between officials that Trump said was supposed to happen on Thursday. Meanwhile, he’s

getting an earful from a wider circle of critics closer to home:

- Turning up his already loud megaphone this week was Thomas Donohue, chief executive officer of the U.S. Chamber of Commerce. The head of the largest lobbying group for American businesses

called for ceasefire and a return to talks. - A large majority of the American companies that are members of the U.S.-China Business Council said

they’re committed to China over the long term and don’t plan to leave, according to a survey the group released Thursday. - A coalition of more than 150 trade associations is making

a last-ditch plea to postpone duties on other goods that take effect Sunday, saying they “come at the worst possible time” and that holiday purchases will still be affected. - U.S. stocks look poised to end a four-week skid on hopes that cooler trade heads prevail. The bond market isn’t sending such an optimistic signal: The yield on 10-year Treasuries has lost about a half percentage point in August, the steepest monthly drop since January 2015.

There’s always a chance the two sides could see the potential fallout as too great a risk to take and declare a truce before Saturday ends. As for Trump, he’s planning to monitor a hurricane bound for Florida for part of this weekend at Camp David, the woodsy presidential getaway just north of Washington that’s also a prime location to meet with advisers and maybe talk trade strategy over a summer holiday cookout.

Charting the Trade War

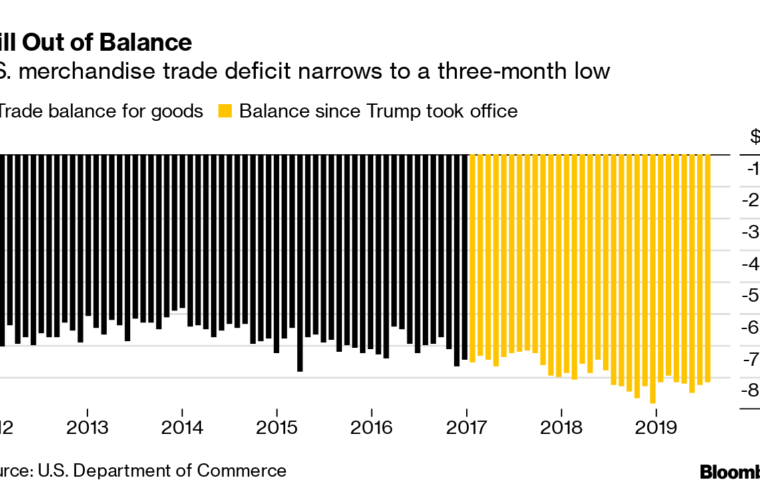

The U.S. merchandise-trade deficit

unexpectedly narrowed in July to a three-month low as exports picked up and imports declined.

Today’s Must Reads

-

Crushed kiwi | New Zealand’s dollar has tumbled this month more than any other Group of 10 currency as economic data deteriorated in the South Pacific nation that depends on trade. -

Leaving China | Abercrombie & Fitch is pushing to reduce its dependence on Chinese suppliers by more than 40% from last year as tariffs hurt profits and the apparel retailer’s share price.

- Luring investors | China said it would lower taxes and ease restrictions on cross-border money flows in the new free-trade area in Shanghai, a move aimed at attracting foreign investment.

-

Rerouting steel | A British tycoon’s Liberty Steel plans to weather the threats to its steel business by pumping more than $440 million into European plants bought from ArcelorMittal. -

Yuan effects | Tesla raised car prices in China by about 2%, responding to trade tensions that are landing the twin blows of a weaker yuan and import tariffs on its lineup of electric vehicles.

Economic Analysis

- Benefiting from Mercosur | Certification and testing companies could get a boost from the EU-Mercosur trade agreement.

Coming Up

- Sept. 1: South Korea trade balance for August

- Sept. 4: U.S. trade balance for July

Like Terms of Trade?

Don’t keep it to yourself. Colleagues and friends can sign up here. We also publish Balance of Power, a daily briefing on the latest in global politics.

For even more: Subscribe to Bloomberg All Access for full global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close.

How are we doing? We want to hear what you think about this newsletter. Let our trade tsar know.

— With assistance by Eddie Spence