Emerging-market watchers may be confident the rally will continue into 2021, but it’s the roll-out of vaccination programs that concerns them the most.

A Bloomberg survey of 63 investors, strategists and traders found the efficacy of coronavirus vaccines is likely to be the biggest market driver for next year, beating out worries about the fiscal laxity of governments and China’s economic growth path. China still emerged as the overwhelming favorite across currencies and stocks, while investors were most optimistic for Latin American bonds, the Nov. 18-25 poll found. Argentina remained a source of unease.

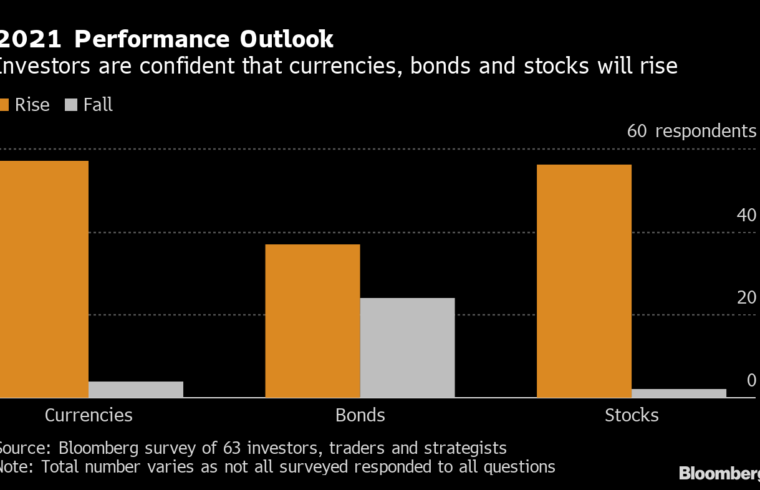

2021 Performance Outlook

Investors are confident that currencies, bonds and stocks will rise

Source: Bloomberg survey of 63 investors, traders and strategists

To listen to a podcast on the survey, click

here.

The findings underscore how the battle against the Covid-19 pathogen turned markets on their heads in the past 12 months, forcing investors to throw out the playbook and look for fresh cues for the direction of asset prices. After collapsing in the first half, emerging markets have rebounded to hand investors more than $5 trillion in wealth this year largely as vaccine breakthroughs supported risk assets. Bonds have climbed to near record highs, while benchmark gauges of stocks and currencies are at their strongest levels in more than two years.

Emerging-market watchers may be confident the rally will continue into 2021, but it’s the roll-out of Covid-19 vaccination programs that concerns them the most. A Bloomberg survey of 63 investors, strategists and traders found the efficacy of coronavirus vaccines is likely to be the biggest market driver for next year. Marcus Wong discusses the details on “Bloomberg

Markets: Asia.” (Source: Bloomberg)

“As economies reopen, vaccines are distributed and risk appetite returns, 2021 could be a break-out year for emerging markets, especially if the U.S. dollar continues to weaken,” Christopher White, a London-based co-manager of the emerging markets discovery fund at Somerset Capital Management LLP. “An unprecedented U.S. peacetime fiscal deficit combined with aggressive monetary stimulus is putting pressure on the dollar, which is very helpful for many emerging economies.”

Read the last EM survey

here. For a list of previous surveys, click here.

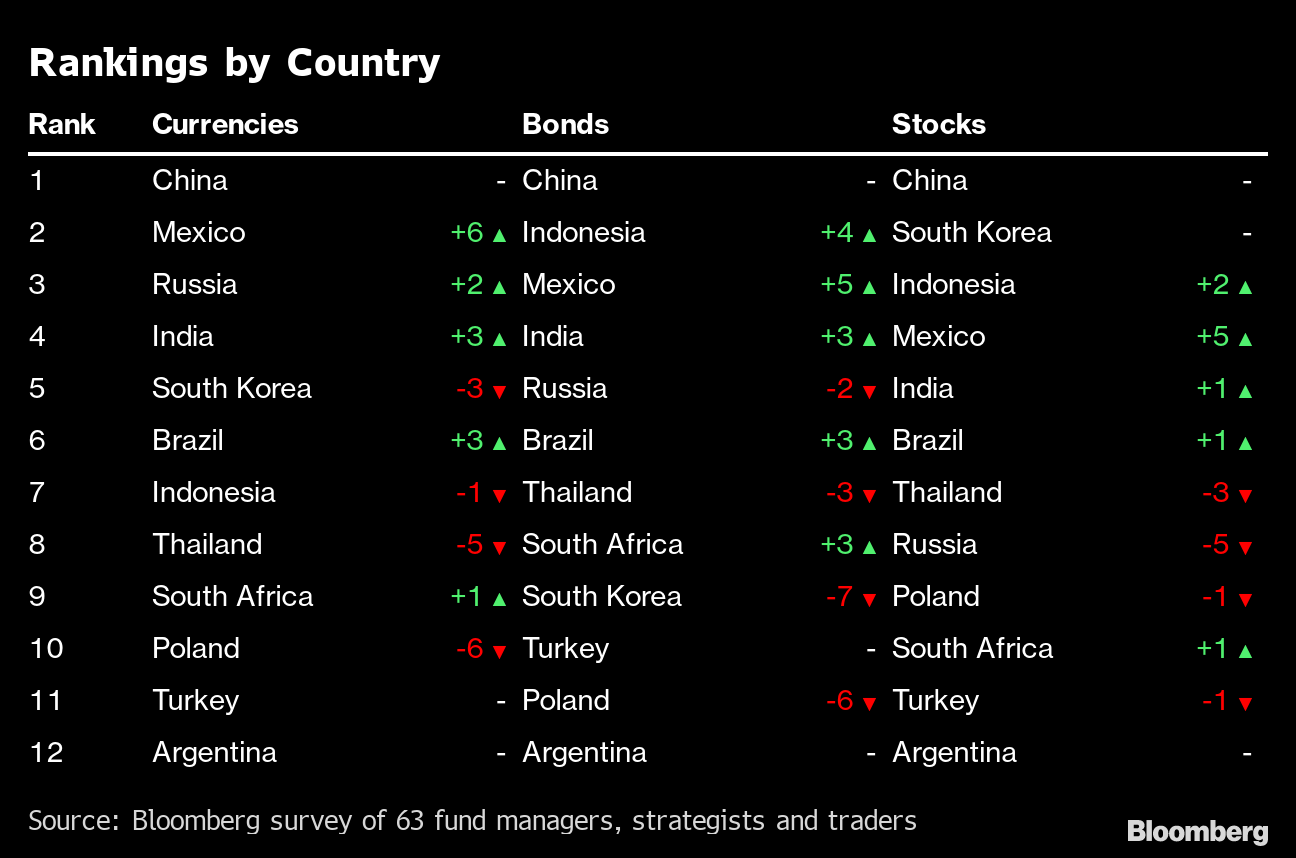

Asia kept its top position for currencies and stocks as the region leads the recovery from the pandemic, the survey showed. Latin America, with relatively higher yields, eclipsed other regions as offering the best prospects for bonds.

Regional Comparison

Asia remains the most favored destination for currencies and stocks

Source: Bloomberg survey of 63 fund managers, strategists and traders

The outlook for China’s economy remained one of the top three likely determinants for prices in 2021. Stimulus spending and its impact on the fiscal health of governments took the third spot as worries emerged over how much scope central banks have left to lower borrowing costs.

Biggest Emerging-Market Drivers

Vaccine efficacy and China’s growth outlook are investors’ chief concerns

Source: Bloomberg survey of 63 fund managers, strategists and traders

U.S. stimulus will remain key to risk appetite, with a majority of respondents estimating the U.S. will approve a package of between $1 trillion and $2 trillion to revive the world’s biggest economy. Crucial to reaching a bigger package than the $916 billion

being discussed will be the outcome of the Jan. 5

run-off elections in Georgia’s two Senate seats.

Stimulus Shot

Most participants expect the U.S. to announce fiscal aid of between $1 to $2 trillion in the next six months

Source: Bloomberg survey of 63 investors, traders and strategists

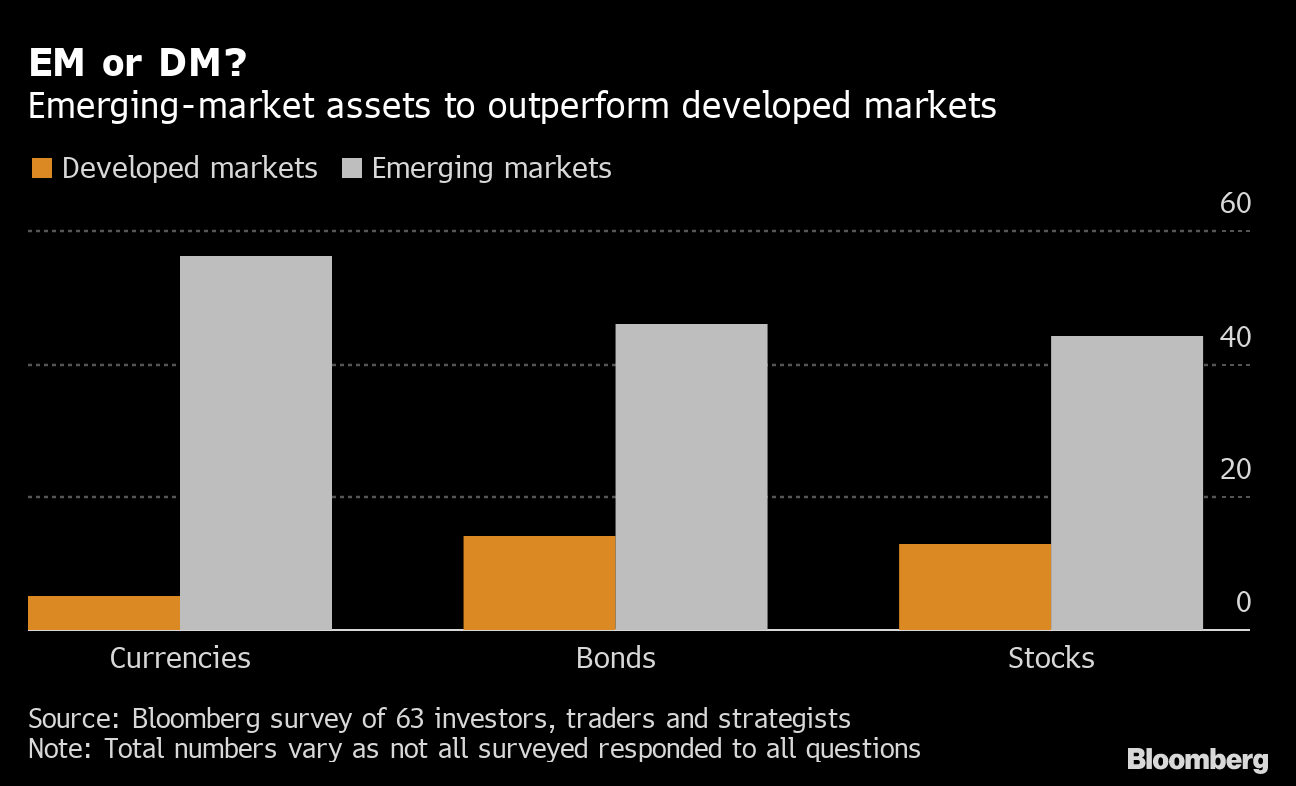

With the global stock of negative-yielding debt near $18 trillion, the hunt for higher returns will continue to favor emerging markets over developed peers. Total wealth in developing-nation stocks and bonds now exceeds $33 trillion, more than the economies of the U.S., Germany and Japan combined.

EM or DM?

Emerging-market assets to outperform developed markets

Source: Bloomberg survey of 63 investors, traders and strategists

That total stood at $28 trillion at the start of the year, based on data compiled by Bloomberg using the market capitalization of equities from 27 nations listed by MSCI Inc. along with Bloomberg Barclays indexes of local- and foreign-currency bonds.

Higher-yielding currencies and bonds, such as those in Mexico, Brazil and India, were favored in the survey, a shift from the previous poll, when low yielders including South Korea, Thailand and Poland were preferred. The rally in junk-rated dollar bonds continued this month, sending the average yield to the lowest since February 2018, according to a Bloomberg Barclays index.

Rankings by Country

Source: Bloomberg survey of 63 fund managers, strategists and traders

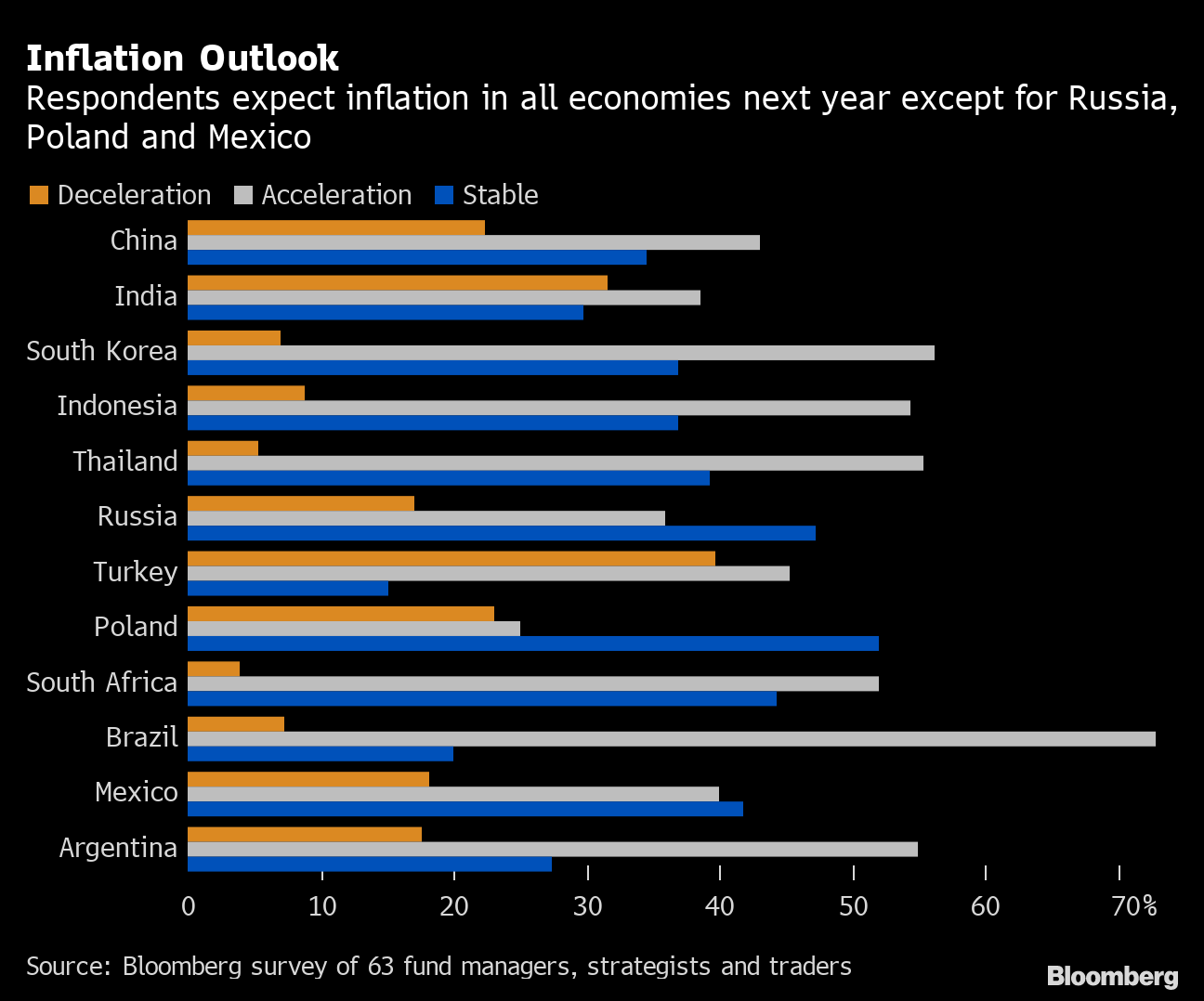

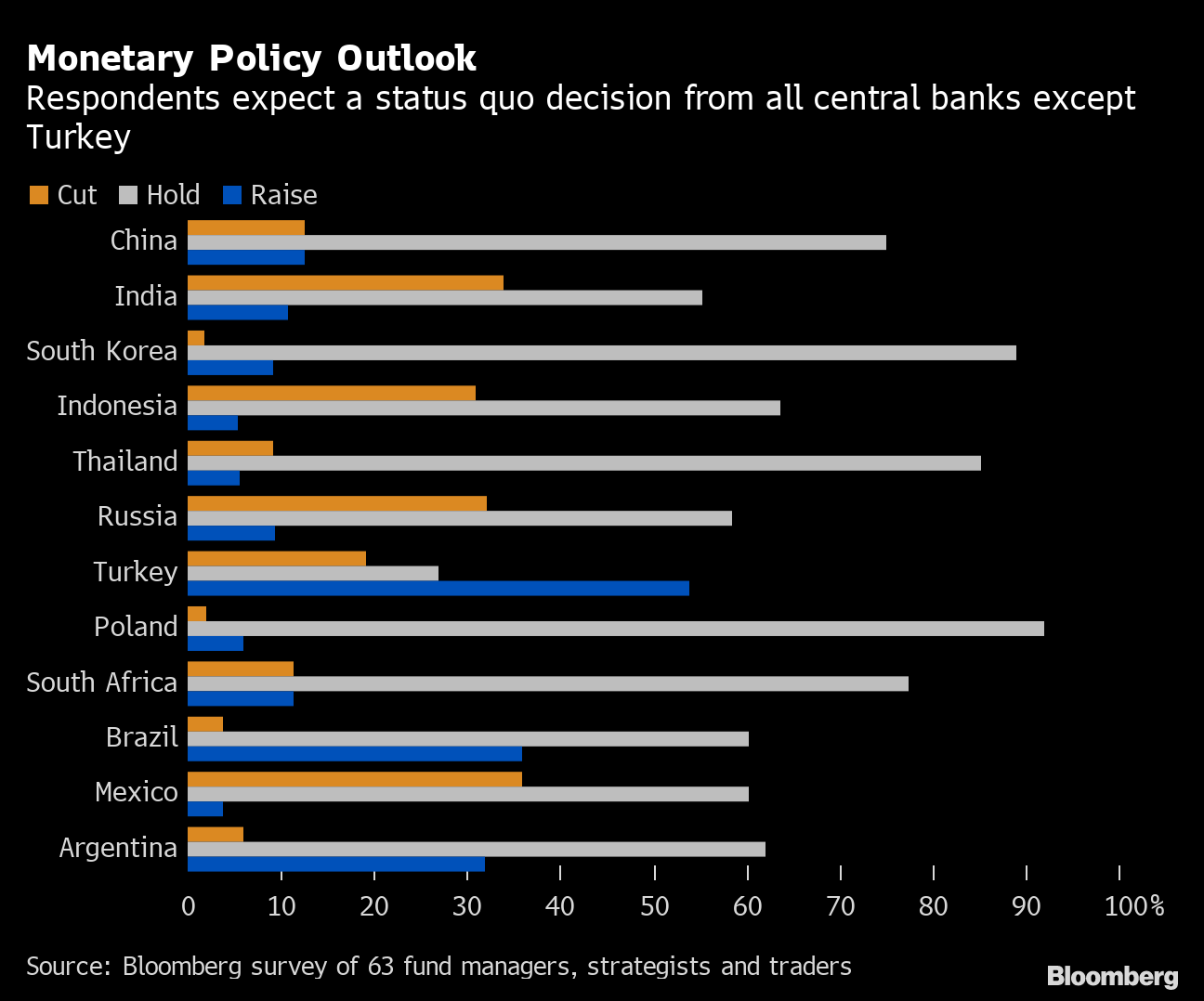

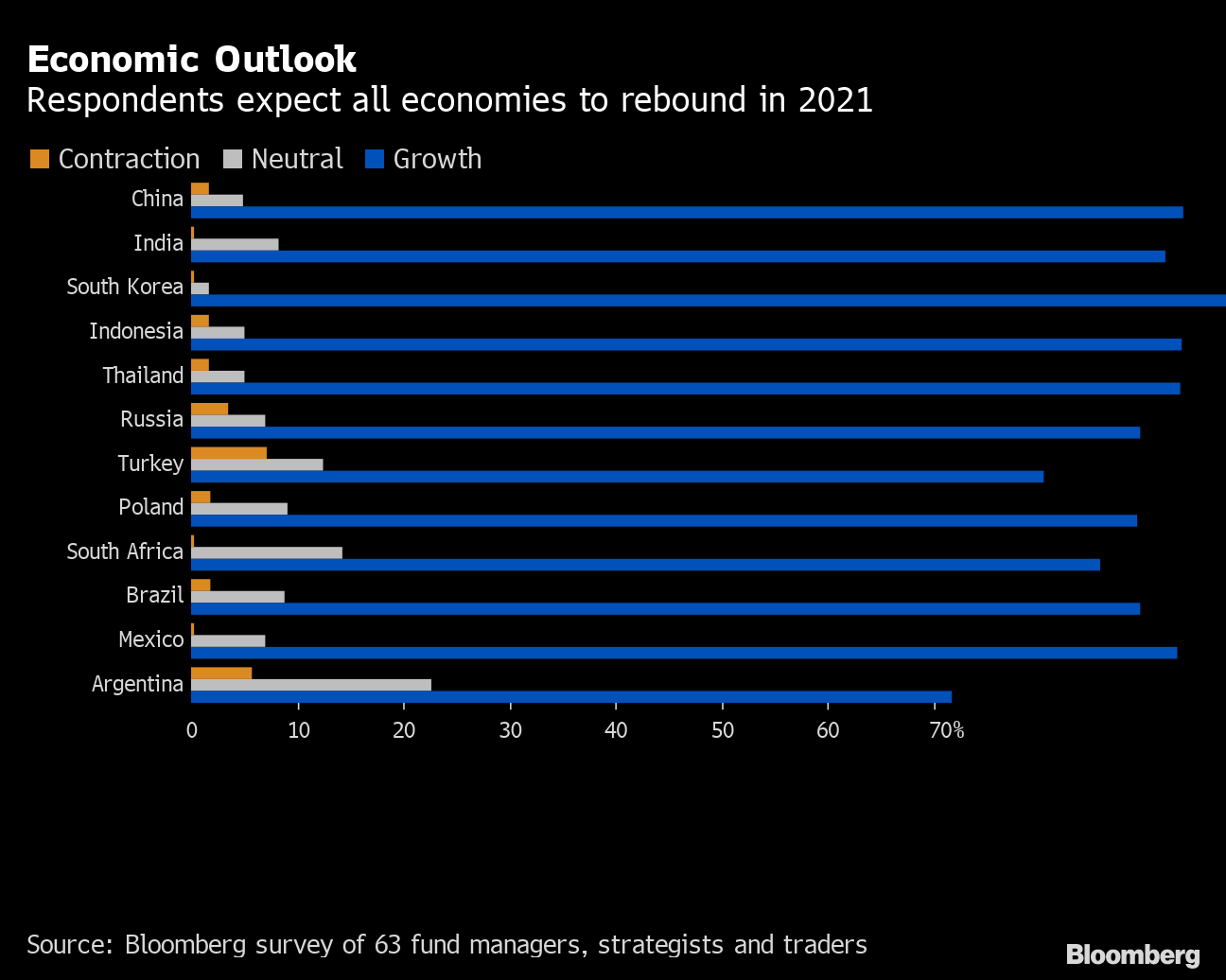

Survey participants were also asked about the outlook for inflation, monetary policy and economic growth across 12 emerging markets. Below are the charts summarizing their views:

Inflation Outlook

Respondents expect inflation in all economies next year except for Russia, Poland and Mexico

Source: Bloomberg survey of 63 fund managers, strategists and traders

Monetary Policy Outlook

Respondents expect a status quo decision from all central banks except Turkey

Source: Bloomberg survey of 63 fund managers, strategists and traders

Economic Outlook

Respondents expect all economies to rebound in 2021

Source: Bloomberg survey of 63 fund managers, strategists and traders

Here is a list of the survey participants:

| Aberdeen Standard Investments | Loomis, Sayles & Co. |

| ADM Investor Services International | M&G Investments |

| AllianceBernstein Holding LP | Marketfield Asset Management LLC |

| Amundi Asset Management | Maybank Kim Eng |

| Aperture Investors | Mediolanum International Funds |

| Argentem Creek Partners | MFS Investment Management |

| Asset Management One Co. | Mirae Asset Global Investments LLC |

| Auerbach Grayson | Monex Europe |

| Australia & New Zealand Banking Group Ltd. | Monex Inc. |

| Axi | Nikko Asset Management Europe Ltd |

| Balchug Capital CJSC | Nomura Holdings Inc. |

| Banco Bilbao Vizcaya Argentaria SA | Office Fukaya, Research & Consulting |

| BNP Paribas Asset Management | Pictet Asset Management |

| Capitulum Asset Management GmbH | Promeritum Investment Management LLP |

| Credit Suisse Group AG | Rabobank |

| DBS Group Holdings Ltd. | Robeco Institutional Asset Management BV |

| Deltec Asset Management | SCB Securities Co. |

| Deutsche Bank International Private Bank | Schroders Plc |

| DuPont Capital Management | Societe Generale SA |

| Falanx Assynt | Somerset Capital Management |

| Federated Hermes | State Street Corporation |

| Fidelity International | Sumitomo Mitsui DS Asset Management Co. |

| Gemcorp Capital LLP | TD Securities |

| Great Hill Capital, LLC | The Global CIO Office |

| GW&K Investment Management | TS Lombard |

| HSBC Global Asset Management | UBS Asset Management |

| ING Groep NV | Union Investment Privatfonds GmbH |

| Insight Investment Management Global Ltd | UOB Asset Management |

| J.P. Morgan Asset Management | UOB Private Bank |

| Janus Henderson Investors | Vanguard Asset Management Co. |

| Kasikornbank Pcl | Wells Fargo Securities |

| Legal & General Investment Management |

— With assistance by Adrian Krajewski, Aine Quinn, Ben Bartenstein, Justin Villamil, Livia Yap, Payne Lubbers, and Sydney Maki