Pedestrians walk along Wall Street near the New York Stock Exchange (NYSE) in New York, U.S., on Friday, Oct. 5, 2018. A severe sell-off in technology stocks has pushed the front-month VIX futures contract to a premium relative to the second-month contract. Photographer: Michael Nagle/Bloomberg

Photographer: Michael Nagle/Bloomberg

Stock investors who managed to ignore sagging earnings estimates were rewarded with the biggest January rally since 1987. Will they be as sanguine should the profit pain persist?

It’s a question they may soon need an answer for.

After lurching into Christmas, U.S. stocks had staged an almost uninterrupted rebound in 2019 before hitting a wall this week and ending virtually flat. It happened against a worrisome backdrop in which skeptical analysts have cut estimates for first-quarter profit growth below zero for the first time in three years.

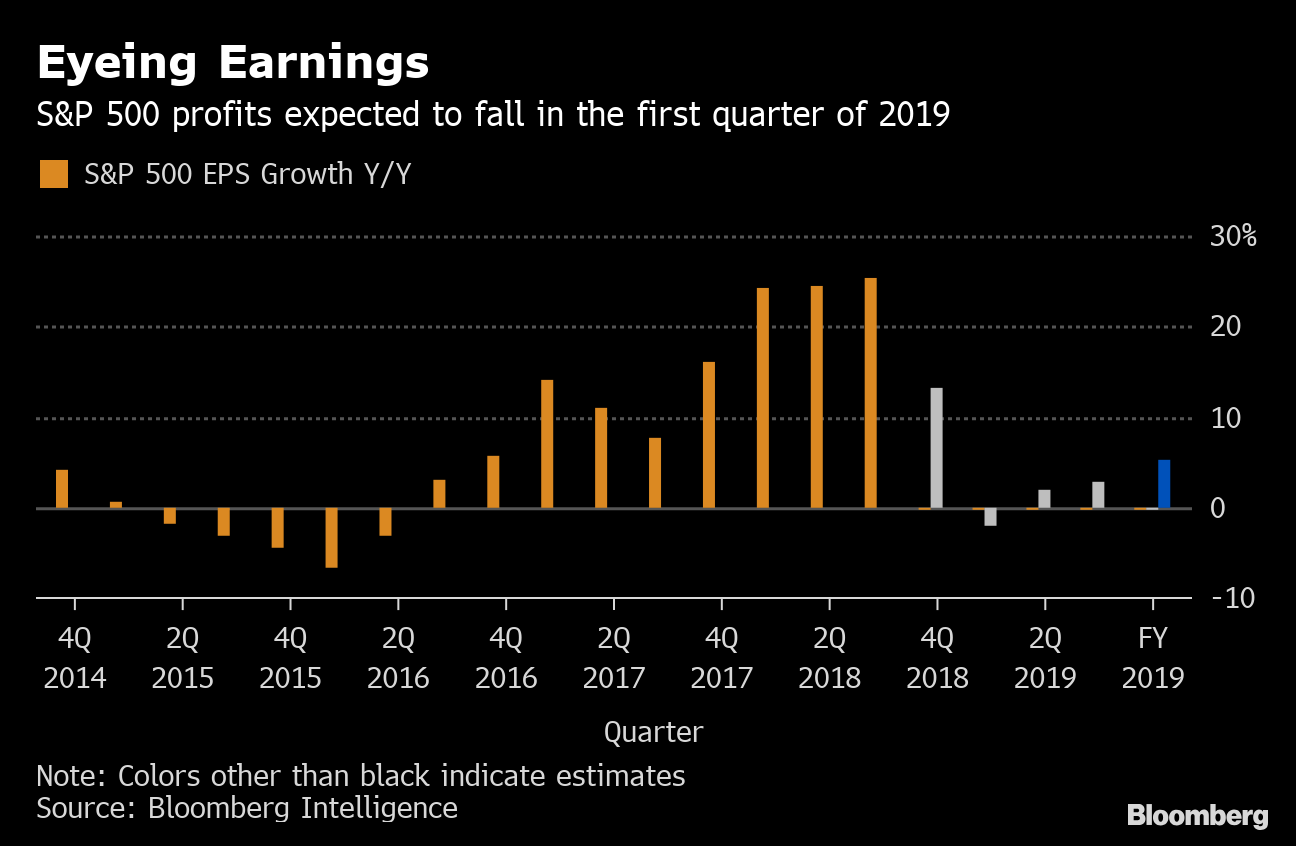

Eyeing Earnings

S&P 500 profits expected to fall in the first quarter of 2019

Source: Bloomberg Intelligence

No problem, say the bulls. Valuations are reasonable. Earnings for the full year are still predicted to climb 5.4 percent. But a concern lurks for anyone who has followed markets for very long: Wall Street’s near-perfect record of over-estimating growth. Short declines in profits have a habit of turning into long ones. And most of this year’s gains expected are clustered precariously at its end.

“We’ve had a big rally, people are confident that recession fears were overblown, the Fed is more dovish than expected,’’ Alec Young, managing director of global markets research at FTSE Russell, said by phone. “It’s a back-end loaded year, which people don’t like to see because everyone knows that analysts revise the numbers down as the year goes on. That’s unnerving.’’

Particularly if you assume stocks follow the path of profits. And while single-quarter drops don’t mean much, earnings recessions that last longer have the potential to stoke volatility and bring out the bears. Right now, according to analysts, S&P 500 income will fall in the first quarter, then inch higher in the second and third.

Bulls better hope it does. Profit declines that extend past two quarters have virtually never stopped there since the Great Depression. Among 18 that got to nine months, exactly one didn’t keep going, in 1967. And contractions of three quarters or more have triggered bear markets 78 percent of the time over the past eight decades.

Analysts have been furiously guiding down forecasts since the start of the year. Earnings-per-share targets for the period starting in January have fallen 4.2 percent, according to

Bloomberg Intelligence data, signaling the potential for a profit recession.

Still, the S&P 500 rallied 7.9 percent in January. Credit a December sell-off gone too far or a Federal Reserve turned dovish for the outsize rally. Some analysts, including

Ned Davis Research, aren’t sold the worst is over. Topping the worry list is an earnings recession that shakes the market from its course.

Full-year earnings estimates normally drop by about half a percentage point each month, according to Ed Keon, chief investment strategist at QMA, and this year has already seen more rapid declines. Coming into 2019, forecasts called for

8.3 percent earnings growth for the S&P 500 in 2019. Now it’s less than 6 percent, with cuts coming quadruple the usual rate.

“Although 6 percent doesn’t sound bad, most of the time when you’re expecting 6 percent at this time of year, you get a negative number,” said Keon, who’s been studying the relationship between earnings and forecasts for a quarter century. “There’s kind of a danger zone when they start the year where they are.’’

If negative earnings growth extends beyond the first quarter, ending in a yearly profit recession, volatility could come back. The most recent earnings recession of 2015 and 2016, which saw five straight quarters of declines, coincided with three of the

largest jumps in equity volatility on record and two 10 percent corrections.

To garner clues on the possibility of a repeat, focus is already turning to the next reporting season that will cover the first three months of 2019.

“The first quarter will probably give us a better indication because if the deceleration on earnings becomes worse than expected, then there will be a potential for higher levels of volatility for the market, potentially dragging it down,” said Omar Aguilar, the chief investment officer for equities at Charles Schwab Investment Management. “Right now I feel that the estimate was down and out that we’d see positive surprises, but I certainly think as we continue to go, people will probably have to adjust even further down their estimates.”