Photographer: Kerem Uzel/AFP via Getty Images

Photographer: Kerem Uzel/AFP via Getty Images

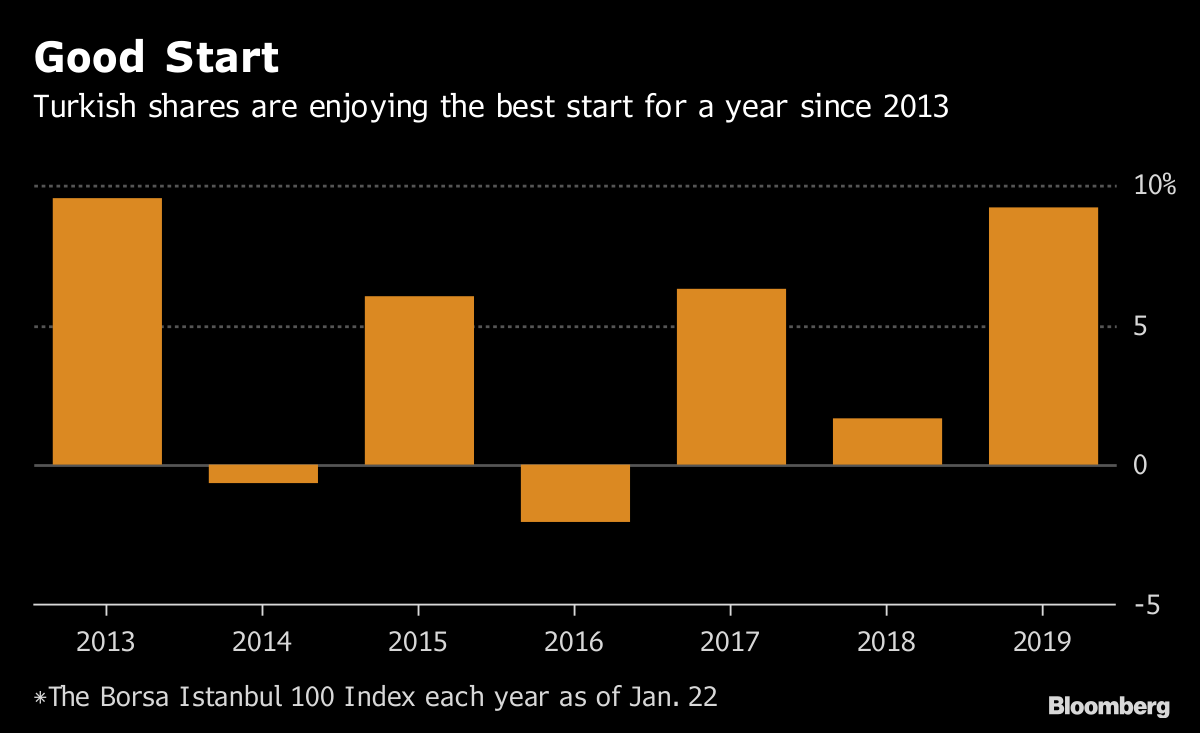

After a dismal 2018, Turkish stocks are enjoying their strongest start to a new year since 2013 as investors scoop up battered shares amid easing concerns over political risks. Now comes the big test.

The main Turkish stock gauge has climbed almost 9 percent since the beginning of January, led by shares including Turkcell Iletisim Hizmetleri AS, Turkiye Petrol Rafinerileri AS, and Turkiye Garanti Bankasi AS. The gain so far this year is more than double that for shares from developing economies, a surprisingly strong performance for a market that has scared away foreign investors last year amid a roller-coaster of political events.

The Borsa Istanbul 100 Index now faces resistance at a big psychological threshold: 100,000 points. The benchmark hasn’t traded above the level since early October 2018. It tested it on Wednesday, and managed to close just above the line, at 100,141.04.

Good Start

Turkish shares are enjoying the best start for a year since 2013

While assets from emerging markets in general are posting a recovery this year amid signs of easing trade tensions, investors looking at Turkish stocks are seeing a relatively calm geopolitical backdrop, combined with attractive valuation and a more stable currency.

| Plus: |

|---|

|

|

|

“It’ll be a year with good stock-picking opportunities, given the attractive valuations of high quality companies with a strong balance sheet,” said Emre Akcakmak, a portfolio adviser at East Capital in Dubai who helps manage $4 billion. “However, it is unlikely that Turkey will be a basket case, given the economic challenges the country will continue to face.”

Read more on why Turkish banking stocks started 2019 with a fighting comeback rally.

The recent rally in the Borsa Istanbul 100 has pushed the gauge’s 14-day relative strength index exceeding 70 for the past four sessions to a level it hasn’t reached in over 12 months. An RSI reading of 70 or above signals that the index is in overbought territory, and its rally could start losing steam.

(Updates with index’s closing level in third paragraph.)