Narendra Modi Photographer: T. Narayan/Bloomberg

Photographer: T. Narayan/Bloomberg

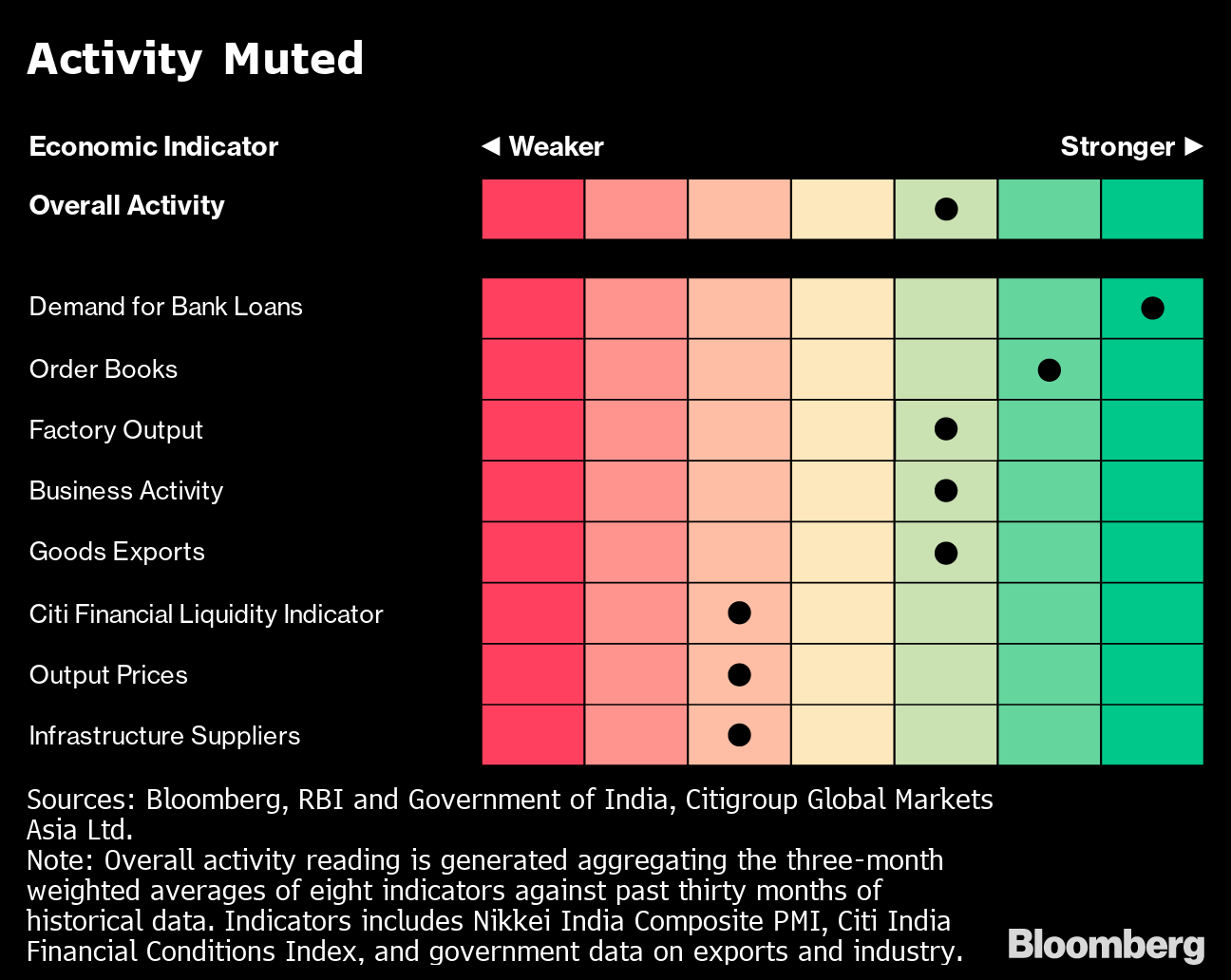

India’s economy showed signs of fragility in May after April’s uptick, suggesting a sustained recovery needs a fiscal stimulus from newly re-elected Prime Minister Narendra Modi’s government.

Overall activity from eight high-frequency indicators compiled by Bloomberg News show the economy lacked momentum, with the dot remaining unchanged from a month ago. A renewed tightness in liquidity conditions kept business activity subdued. The dashboard is a measure of “animal spirits,” a term coined by British economist John Maynard Keynes to refer to investors’ confidence in taking action.

Activity Muted

Sources: Bloomberg, RBI and Government of India, Citigroup Global Markets Asia Ltd.

As gross domestic product growth slowed to a five-year low of 5.8% in the first quarter of 2019, the Reserve Bank of India this month did its part to support the economy by

lowering interest rates for a third time and switching to an accommodative stance. Further, analysts expect the new Modi government’s first budget on July 5 to

tweak fiscal levers to give a boost to the economy and get it back on a faster growth track.

Here are the details of the dashboard:

Business Activity

In a worrying sign, activity in India’s dominant services sector has been slowing. The seasonally adjusted Nikkei India Services Index fell to 50.2 in May, its weakest level in 12 months. A reading above 50 indicates expansion in activity, while anything below it signals contraction.

The slowness in services was offset by a faster pace of expansion in manufacturing activity. That helped the Nikkei India Composite PMI Output Index remain unchanged at 51.7 in May from a month ago. The reading was the lowest since September.

The survey showed factory gate prices were broadly unchanged from April, indicating pipeline price pressures are likely to stay subdued. The trend mirrors slowing demand pressures in the economy that’s led to an easing in core inflation — which strips out volatile food and fuel prices.

Exports

Probably the only silver lining. Exports grew 3.9% in May from a year ago, with a large part of the increase coming from non-oil products. Non-oil exports growth was at 5.1%, after contracting 3.1% in April. Nevertheless, imports outpaced exports leading to a higher trade deficit. Oil imports grew 8.2% year-on-year, with sharp increases month-on-month despite a drop in prices of India’s crude basket.

Consumer Activity

Consumer spending remained under pressure, with data pointing to sluggish purchases of everything from toothpaste to cars.

Sales of passenger vehicles fell for a seventh straight month in May, the longest stretch of declines since 2014,

data from the Society of Indian Automobile Manufacturers showed. Passenger car sales declined 26% from a year ago, while commercial vehicle sales slumped 10% year-on-year. Two-wheeler sales also contracted 6.7%.

Tractor sales, a broad indicator of rural demand, were down 15.7% from a year ago, suggesting demand was low-key. An uncertain start to the monsoon season, which is crucial for farm output and rural consumption, is likely to weigh on spending in the near term, economists said.

That sentiment lent itself to demand for bank loans, which grew 12.7% in May from a year ago, slower than the 14.2% expansion in the beginning of April, according to central bank data.

The Citi India Financial Conditions Index, a liquidity indicator, showed overall conditions were fairly tight.

Industrial Activity

Growth in India’s

core infrastructure sector, which constitutes 40% of total industrial production, eased to 2.6% in April from 4.7% in March. The muted performance kept a leash on overall factory output, which rose 3.4% from a year ago on the back of otherwise stronger capital goods and consumer-durables production. Both the numbers are reported with a one month lag.

— With assistance by Don Ong, and Adrian Leung