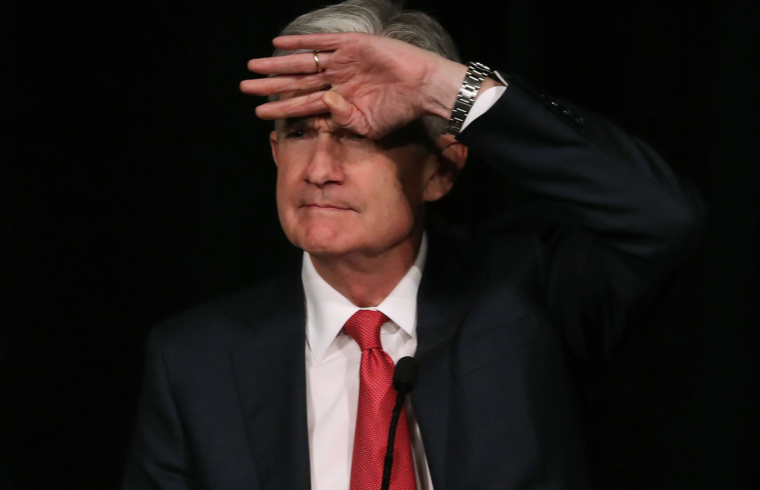

Photographer: Mark Wilson/Getty Images

Photographer: Mark Wilson/Getty Images

To get John Authers’ newsletter delivered directly to your inbox, sign up here.

Nothing to FOMC Here….

Every so often, I make a good call. It’s nice when it happens. So I start by drawing your attention to the final two sentences of yesterday’s newsletter: “Could this be the point when Powell tries to stake out his hawkish credentials once again, and stock market day-traders, mugs though they are, show they have at last learned to anticipate this and price it in? We will know soon enough.”

It turns out that the answer was “yes”. One more good call and I can say I am right as often as a broken clock.

The basics of the announcement were straightforward. The Federal Open Market Committee cut its target rate for the third meeting running, and tried to give itself space not to cut again, also for the third time running. Chairman Jay Powell’s language in the press conference was about as strong.

But it still included a caveat which was enough to reassure everyone that he was no more hawkish than they had feared: “if developments emerge that are a cause for a material reassessment of our outlook, we would respond accordingly.” So, if things go worse than the Fed’s governors expect (which has been known to happen), then they will keep on cutting. While inflation remains under control, we should expect rates to stay where they are.

A “material reassessment” would imply the Fed would need to be proved seriously wrong, which in turn would imply a recession. So we could go along with the gloriously lugubrious assessment of TS Lombard’s U.S. economist Steve Blitz: “This means it will take recessionary signals to cut and that, in turn, means they will be too late to avoid recession.”

That is in line with the lesson of history — if the Fed cuts by more than 75 basis points in a cycle, a recession invariably results. Distilling this further, either there is a recession, or the Fed has cut as much as anyone could have hoped. Now, eat, drink and make merry.

It looks as though the market is at last inclined to believe him, while investors in stocks were implicitly braced for worse. This is the Bloomberg WIRP (World Interest Rate Probabilities) function read-out for the chances at the next meeting, in December, as derived from the fed funds futures market. The blue line shows how the chances of holding at the current level have moved over time, while the red line shows the chances of a cut. As far as this measure is concerned, the chance of a fourth cut is now only about one in five:

In other words, data between now and December would have to be a horror show. As a huge chunk of that data is due on Friday, which will feature both the latest non-farm payrolls and the latest ISM manufacturing survey, we will know soon enough.

Looking further out to the probabilities for the meeting that will be held a year from now, on the day after the U.S. presidential election, we discover that the odds of a further cut by then are now 70% — still uncomfortably high given that this implies a recession, but down from 95% earlier this month. The following chart, clumsily drawn by me in Excel, shows how the market assessment for the chance of lower rates next November has changed:

The pattern across almost all affected asset classes was much the same: This FOMC was regarded as positive as far as it went, but not hugely surprising. The S&P 500 managed to set a new all-time high, albeit one led by low-volatility and rate-sensitive stocks, while the dollar weakened a bit and is now back below its 200-day moving average, according to the Bloomberg dollar spot index — in current circumstances a sign of optimism.

Bond markets marred the sense of optimism by gaining, with yields falling. But this at least helped narrow slightly the huge disparity in Treasury yields over German bunds, which has helped to attract flows of money into the U.S. and the dollar:

The final analysis is that we have a monetary policy that has tried to take out some insurance, but does not presuppose a recession. Meanwhile, the extreme Fed-sensitivity of the last 12 months or so is likely to dissipate. Hoping for further rate cuts at this point is tantamount to hoping for a recession. It is possible that more Fed cuts will indeed prove to be helpful, but that would not be enough to stop risk assets from falling. From now on, equity markets, no less than the Fed, must be data-dependent. We all can share a hope that the next FOMC meetings will matter a lot less.

Oh Yes, the Data

The FOMC met after the U.S. had published GDP data. They were not very exciting, and suggested that the economy is increasingly reliant on consumption growth, which accounted for substantially all the increase in GDP — without it, all other factors netted to about zero. But in long-term perspective, it is hard to see great reason for concern (outside the manufacturing sector which is a dwindling share of the economy). This is how consumption and GDP have grown over the last 30 years:

One other key measure to be published ahead of the FOMC was the Fed’s favored gauge of inflation, the PCE deflator, which is compiled as part of the GDP accounts. This suggests no risk of overheating and therefore little or no risk of rate rises any time soon:

As has been true for years, inflation gives little reason to raise rates

Friday’s data will probably pack more of a short-term punch — and given the problem of inequality, many Americans would doubtless prefer much stronger growth. But the latest data suggest a benign environment for risk assets. Add to that what appears likely to be a benign Fed, and it grows a little easier to understand how the S&P 500 is at an all-time high.

Tipping Points in the Southern Cone

The images from the streets of Chile have shocked the world over the last two weeks. This isn’t because people had a lot of money invested in Chile, but more because it is the wealthiest and until recently stablest country in the region. I tried my own explanation last week, and then published a follow-up after a lot of Chilean feedback.

Now, the question of exactly why Chile suddenly descended into disorder is gaining momentum. My colleague Tyler Cowen made his own attempt to explain what happened

here, and greatly doubted that it could be attributed to inequality. As numerous Chileans have pointed out, inequality in the country has even been decreasing, albeit from excruciatingly high levels.

Explaining how this could happen becomes an urgent question for assessing risks almost everywhere else. And the more I look at it, the more it seems we need to invoke the nebulous Malcolm Gladwell concept of the “tipping point.” For whatever reason, Chilean opinion suddenly tipped. A rise in transport fares was the catalyst, but certainly not the underlying cause.

For a tipping point, just look at the president’s approval rating. It dropped steadily, and then collapsed. This is the latest poll from the Chilean pollster Plaza Publica. The purple line is for disapproval.

The same survey asked for opinions on the reasons for the disorder. The most popular response, mentioned by 41%, was “social discontent” — which begs many questions. “The cost of living” was next with 18%, while inequality was fifth, mentioned by only 12%. For even Chileans, then, it is unclear exactly why this trouble broke out, and why it broke out when it did.

I am planning to write more on this, and would greatly welcome feedback, particularly but not only from Chileans. Why exactly did this happen? The lack of a clear explanation is more unnerving for investors than anything else.

To close for now, I will mention one insight from Peter Atwater of Financial Insyghts, who makes a study of social mood and its effect on markets. He commented that neither the repo market meltdown of a few weeks ago, nor the sudden unrest in Chile, have yet been tagged with a clear explanation. “We don’t like uncertainty to begin with, but uncertainty driven by unknown factors really makes us uncomfortable,” he said. “It raises randomness, which we abhor.”

The lack of narratives is alarming, and he suggests that another “event” without a clear explanation could set people even further on edge. So please, let us try to explain what happened in Chile.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the editor responsible for this story:

Matthew Brooker at mbrooker1@bloomberg.net